Drywall Repair

If you have a property that the sewer line constantly backs up

from roots or whatever… or maybe have one of those ALIEN tenants?

You may want to take look at this! Could save a major indoor cleanup.

You can get one here or I’m sure other places. Just google it.

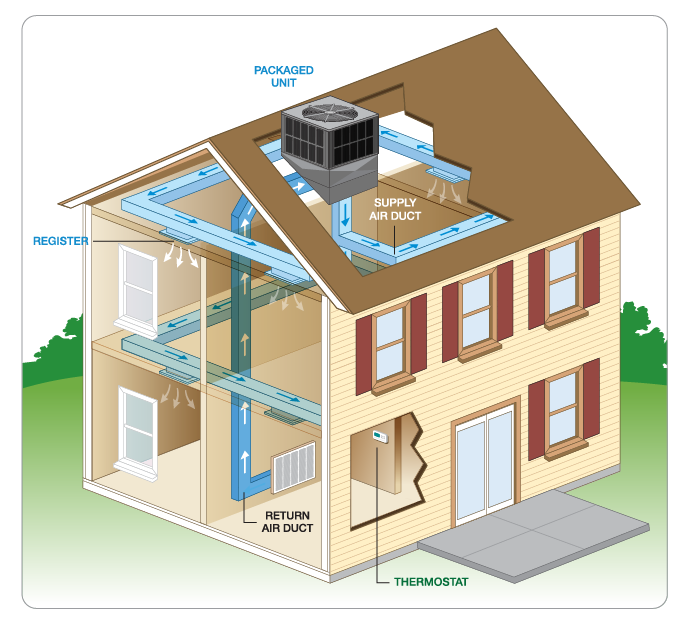

Packaged Air Conditioners : The compressor, coils, air handler are all housed in a single-boxed cabinet. The packaged air conditioner can also provide limited warmth by using an electrical strip heating.

Operation depends on configuration, but packaged systems typically heat and cool your home the same way their stand-alone counterparts do. The ducting with a single cabinet system is slightly different. The duct work is attached to the system rather than connecting to various components in your home.

From https://www.goodmanmfg.com/resources/heating-cooling-101/how-a-packaged-system-works

Come One, Come All!!

Come join us and learn the basics of real estate investing. We

cover flipping, landlording and most especially how to buy the

right way and not overspend.

We have prepared the classes to take in order to earn the

Professional Housing Provider designation developed by the

National Real Estate Investor Association.

Classes will be taught by experts in their fields and as a bonus

they are fellow AIA members and/or sponsors. (AIA members

get a discount)

So, come join your fellow investors and learn how to start

investing successfully!

PHP program – $1,150 full price

$ 950 for AIA members

For a married couple – one spouse pays 50%

For two business partners – one partner pays 75%

THE PROFESSIONAL HOUSING PROVIDER PROGRAM

Presented by AIA/ALREIA

Twenty classes will be offered of 3 hours each for a total program length

of 60 hours as required by the National REIA. Classes will meet on

Tuesdays and Thursdays from 6-9PM at the New Vocation Realty School

at 2017 Canyon Road Suite 45 Vestavia Hills, AL 35216. Classes will be

recorded in order to assist the students in completing the program.

TOPICS INCLUDE:

BUYING RIGHT

SELLING PROFITABLY

REHABBING

LANDLORDING

APPRAISAL

PURCHASING

NEGOTIATION

TAXES

INSURANCE

CONTRACTS/LEASES

MARKETING

FINANCING

FAIR HOUSING

INSPECTIONS

MANAGEMENT

FED & LOCAL REGS

ETHICS

&

15 HOURS OF STUDENT

CHOSEN ELECTIVES

Chuck Robertson has been teaching

Real Estate for several years and

coordinated the PHP program the last

time it was offered. He has been a real

estate appraiser for 19 years and got

his broker’s license in 2005. He

currently serves as President of the

Alabama Real Estate Educators

Association. Chuck has been a

member of AIA for over ten years.

To Signup, please contact...

AIA LADIES NIGHT

Monday night 5:30 at

Vestavia Chamber Conference room

Vestavia Chamber conference room will host the “AIA LADIES Meeting” on this Monday night @ 1975 MerryVale Road Vestavia Hills 35216. It is actually right on 31 hwy, but the turn in is merryvale rd. It is the monthly Meet Up meeting for July! My cell number is below if you get turned around. Be there at 5:30…

Bring a small amount of your favorite dessert for tasting, and coffee or water, will be supplied. Plans are to do one of these ladies meetings per quarter if you all want to. I want a couple of ladies to step up, and lead this effort to involve all AIA ladies. AIA will do our best to meet your needs, and concerns, so you can do MORE Real Estate Investing. That is what this is all about plus networking. Let me hear your needs and concerns- contractors is likely #1, and can plan for in the next meeting.

I will speak a bit Monday on “Why Real Estate Investing compared to Stock Market Investing is safer, more consistent, with great tax advantages for you if needed, with virtually no downside risk, that Tenants are not willing to pay for?” Building Wealth over time with Real Estate for anyone who likes the idea of Real Estate, can be a terrific retirement plan. I have done both since 1975, plus some other things, that may help you in your planning. If this subject is currently something hot with you and your mate, that he needs to hear, then bring him, and we will do our best to get him in the room or can meet with both later 1 on 1. Bring calculators, and I will have TWO very key Tax Forms for you to learn & Master. Maybe even show briefly, how I built my own Banking System for real estate that I have never gotten turned down on for a loan, and how I funded my personal Real Estate investing for 35 years. For me, and to my knowledge, there is no better Financial Plan than what I will show you Monday night (free)- if you are ok with real estate?

Sincerely,

Jack Eyer CSCS

205-586-4260 cell

AIA CHAIRMAN

I hear people giving financial advice all the time. Most of them aren’t rich.

Those who are rich would disagree with what many charlatans preach. The other day, I came across an article proclaiming, “Skip your lunch, don’t buy expensive coffee, cut your hair less often.” This is a horrendous way to live your life and it promotes poverty. It’s smart to be thrifty, but you don’t want to be cheap. You should never do anything that will deprive you from your joy.

I promote prosperity–and taking away these simple pleasures will not make you rich. It will drive you to be more frustrated from these unrealistic disciplines. Most of these hypocrites who profess these antics haven’t even made it financially. They just sit at a keyboard in a delusional manner, waiting for a payday that often never happens.

Financial advice is freely given by most people, but most of it is horrible. Conversely, the words you are currently reading are written by someone who is a self-made millionaire. Therefore, watch whom you learn from, for it is in your best interest (pun intended).

If you’re naturally a hard worker with a great career and have been diligent in all your affairs, you can have prosperity now. However, you might be asking, “Why haven’t I made it yet?” The answer to this question is in the way you think, feel, and act toward your money. Making better choices with your money can turn your life around.

There are certain financial mistakes that rich people never make. The journey in becoming rich will require you to make a few mental changes in your behaviors. Once you make these adjustments, you will begin to see the progress as your create more positive results in your life. Acquiring wealth is a great goal, but who you become in the process is even more worthwhile.

Here are 10 financial mistakes rich people never make:

America’s first millionaire, Benjamin Franklin, was known for saying, “An investment in yourself pays the best interest.” Often, people depend on their employers to buy them books, send them to seminars, or provide them with coaching. However, you must take your education into your own hands if you want to prosper. Invest in yourself.

Related: 7 Networking Tips From a Real Millionaire

Yesterday, I popped into a local Dave and Buster’s to see the grand opening. It was crowded with hundreds of young adults (ages 21-35) who were wasting precious time and money. Most people spend 30-50 percent of their paychecks on entertainment, while they temporarily escape the realities of life. Instead, rich people use that time and money to fund their dreams.

Many people purchase objects they can’t afford with money they don’t have to impress people they don’t like. This tragedy decimates many people, leaving them with a hopeless feeling when they repay their high-interest loans. If a person hopes to become rich, they will use their credit cards for growing and promoting their business, not funding personal expenditures.

Millions of married couples don’t talk about money. It makes them uncomfortable, which sometimes leads to arguments. However, you cannot get rich unless you disclose your financial precepts with your spouse. Money is only multiplied when love is in the mix and both members of the household have a clear understanding about their finances.

Some “rich” people mortgage their homes, but they aren’t really rich. Mortgaging your home leads to an endless battle of re-financing, bill-paying, and inflation. When you mortgage a home, you’re likely to pay twice as much asthe original price! Rich people rent until they can buy their house with straight cash, like I did.

Our retirement system is a joke that must be evaded by those who want to become rich. If you’re depending on mutual funds, 401(k), and certain life-insurance policies, you’ll do better boarding the Titanic. Plus, if you’re saving money to enjoy it for your sixties, that’s like saving up sex for retirement! Instead, build your fortune while you are young.

Related: 10 Questions Every Aspiring Millionaire Should Ask

Price shoppers and coupon clippers will hate this, but when you buy shoddy goods, you get shoddy results. If you live by the price, you die by the price. Instead of buying what is “cheap,” buy the best goods that are available. Rich people know that buying a $40 shirt which will last for four years is better than buying a $10 shirt that must be replaced every year.

Consumerism is funny. During 50 weeks at work, people think about vacations and when they finally get their two weeks, they only think about work. The truth about becoming rich is that you must enjoy the money that you already have, whether it’s $10 or $100. Your money will only expand if you appreciate it and think about how you can enjoy it more. You’ll always get more of what you enjoy.

Most people blow their money on miscellaneous goods. When they see ‘X’ amount in their bank account, they automatically think of what they “need” and purchase it immediately. However, this impulsive behavior must be eliminated. Rich people save at least 10 percent of what they earn and rarely take out personal loans for themselves, even if they think they need it. Save.

The majority of people in this world work for money, but rich people let money work for them. They know that their money will be a byproduct of the service that they render to the marketplace. Rich people also acknowledge the fact that their material wealth is the sum total of their entire contribution to society. That’s why they never work for money.

Making these mental shifts can dramatically alter your life. When you start changing your financial habits and avoiding these mistakes, you will be on your path to be rich. Remember, it’s not what you acquire that makes you rich, but who you become in the journey. And of course, I hope to be your neighbor one day; maybe I’ll invite you to my home!

reprinted from http://www.entrepreneur.com

Related: 7 Tips to Becoming a Millionaire